Blog.

Accounts made easy.

⭐ FEBRUARY – WEEK 2

Helpful Hint: Don’t Ignore HMRC Letters — Get Professional Support Immediately

⭐ FEBRUARY – WEEK 2

Helpful Hint: Don’t Ignore HMRC Letters — Get Professional Support Immediately

February is often when HMRC sends out follow-up letters from late returns, estimated bills, or mismatched information.

Many sole traders panic when they receive one… and many try to fix it themselves.

This is where problems begin.

❗ Why You Should Never Try to Deal With HMRC Alone

HMRC letters are often:

- Confusing

- Vague

- Filled with tax jargon

- Missing important detail

And if you respond incorrectly, you could:

- Agree to the wrong amount

- Admit to an error you didn’t make

- Miss appeal deadlines

- Trigger further reviews

- End up paying more than necessary

Trying to DIY your response can cost you money — and your peace of mind.

💼 Why Let Us Handle HMRC for You

When you show us the letter:

- We explain exactly what it means

- We check whether it’s correct

- We identify errors in HMRC’s calculation

- We respond professionally on your behalf

- We ensure you don’t overpay

- We protect you from penalties

Most of the time, the issue is small — but only if handled correctly.

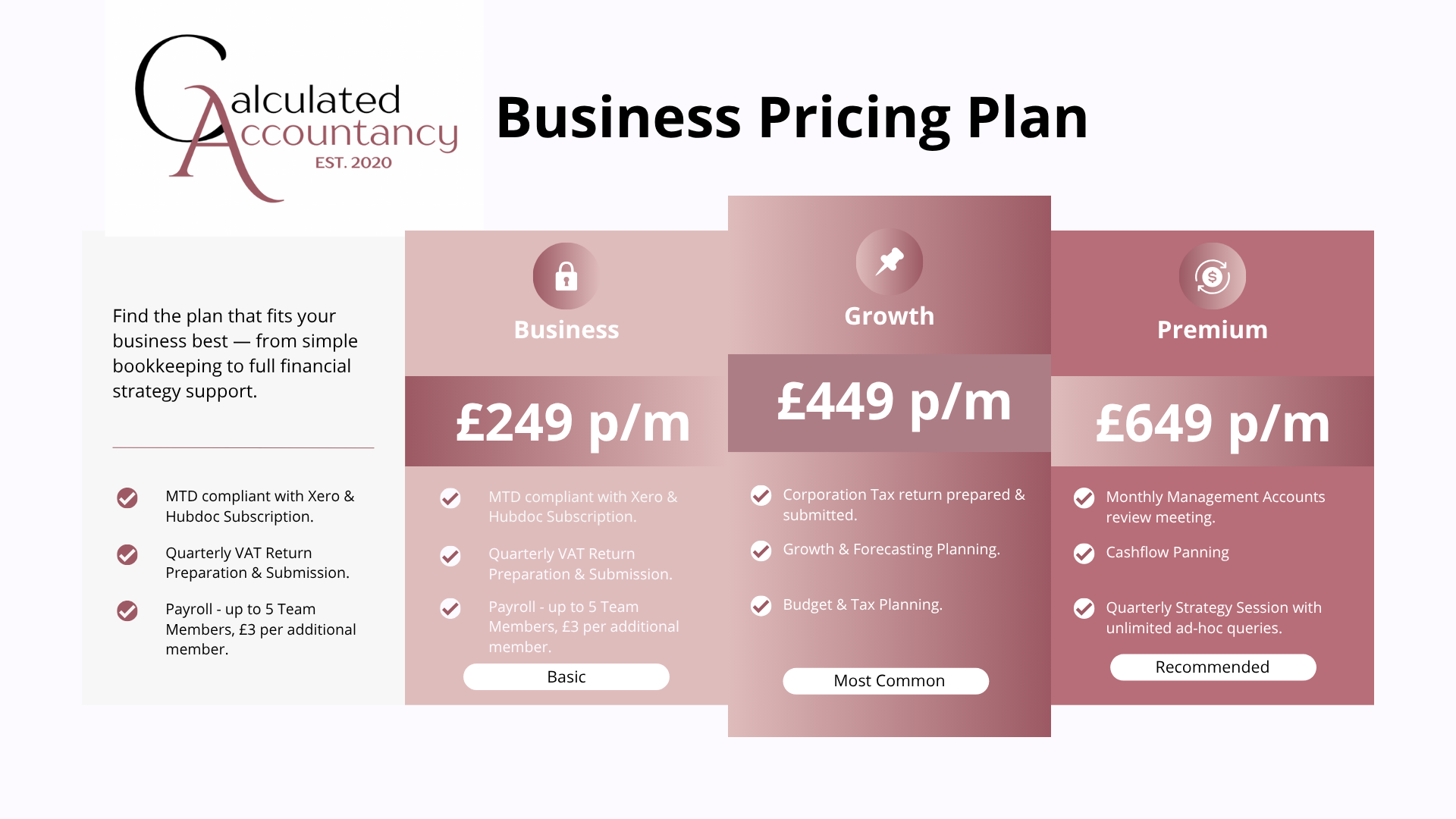

👉 If HMRC writes to you, don’t panic and don’t reply alone. Send it to us and we’ll deal with it properly. *Please bare in mind this is an adhoc support and not included in your assessment prep and submission fee unless you are on our Premium Plan.