Blog.

Accounts made easy.

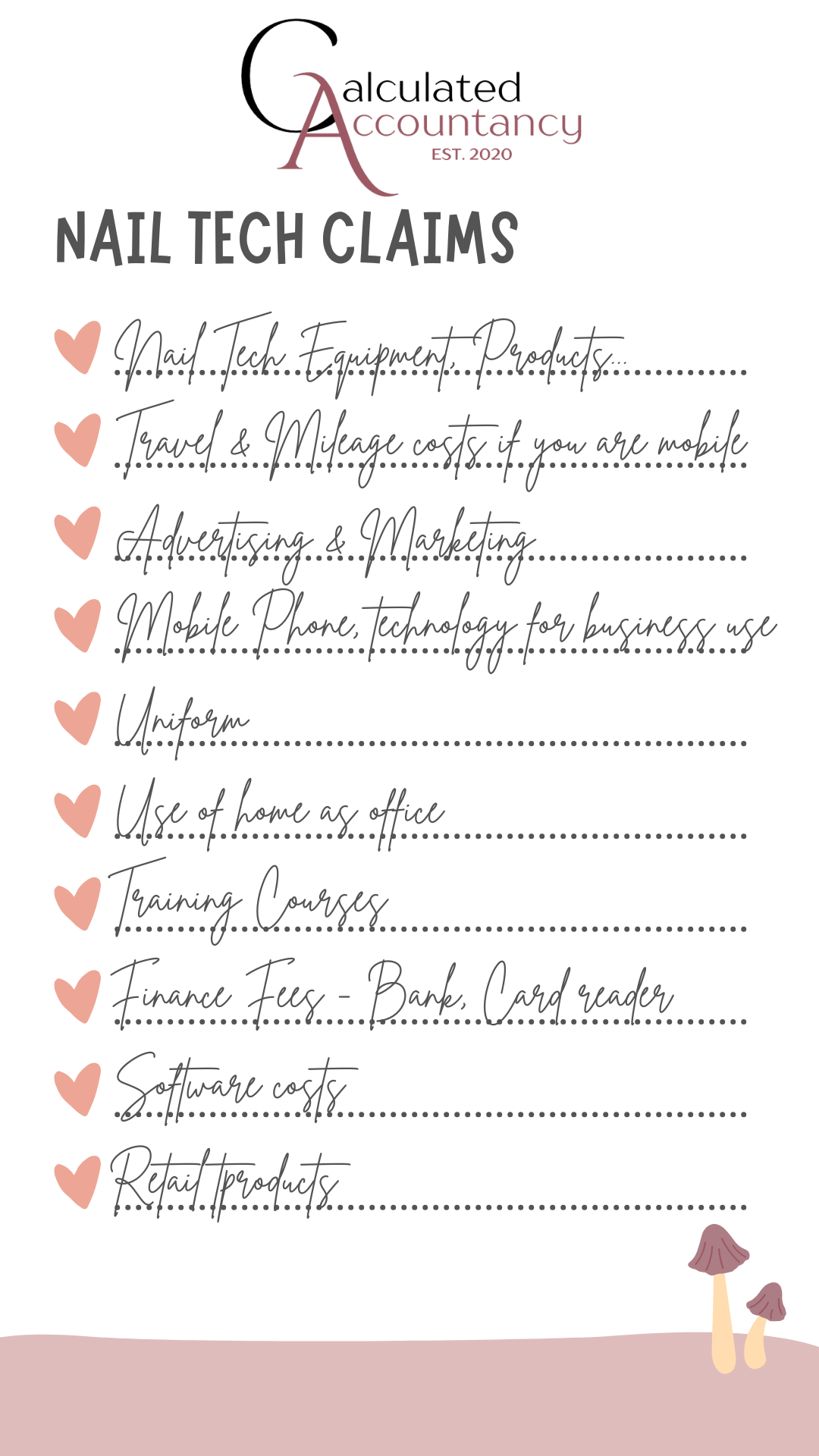

Nail Technicians - What can I claim expenses?

Nail Technicians - what can I claim for my expenses?

There are many things you can claim for to reduce your profit before tax.

Above are just a few.... Remember to ask yourself - "did you purchase this for your business?" or "Do you use it in your business?"

This list is not an exhaustive list. If you are unsure if you can claim it, you just need to ask... we're always happy to help with queries.

With our spreadsheet it helps you keep on top of your finances month by month, in preparation of your self assessment tax return.